Using this information, we compared the rates credit cards are offering to the actual exchange rate in euros on a specific date. If you want to get a good idea of what you might pay beforehand though, both Visa and Mastercard publish their exchange rates: The good news is that the exchange rate that was used will be published on your statement, so you can see what rate you were charged. This means that you might not know the exact exchange rate that will be used to convert your transaction at the time you make a purchase. Generally, network currency conversion is carried out when the transaction is charged a day or 2 after your purchase (once it hits your account). This rate is determined by your network and is generally has a small markup on the current exchange rate between currencies. We’ve talked about some fees you might encounter, but what about the exchange rate your card uses to convert your purchases into USD? If you use your credit/debit card for purchases, you’ll be subject to their current rates. Are Network Currency Exchange Rates Fair? Their compliance division will contact the merchant and work through a solution.

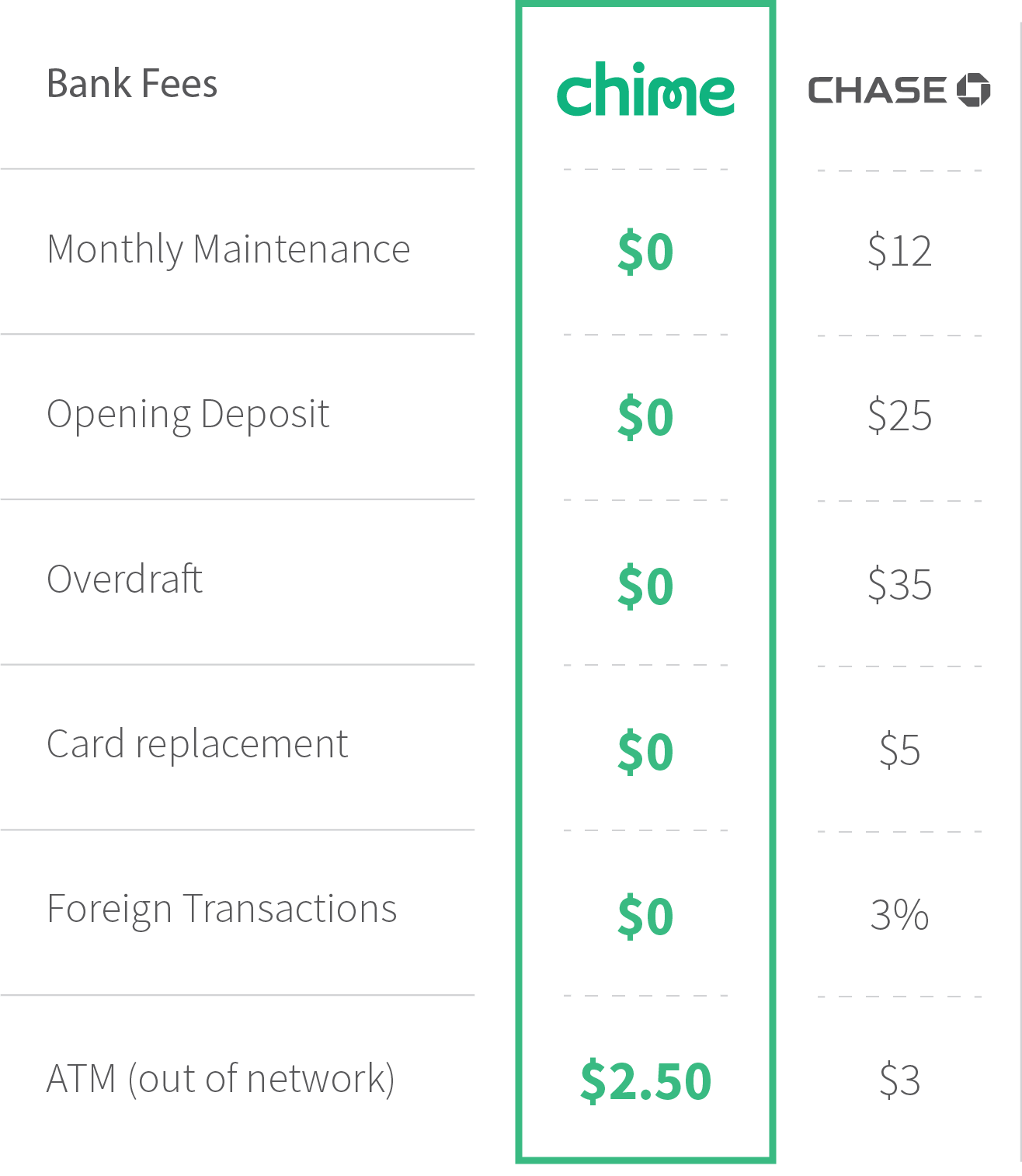

If they can’t help you to resolve the problem, you can also contact your card network (like Visa, Mastercard, or American Express). First, you can contact your card issuer (like Chase, Citi, etc.) and explain the situation. If you don’t catch it immediately, there are still several options to dispute the DCC charges. This is why y ou should always check your bill to make sure the merchant didn’t try to do you a “favor” and convert your currency dynamically without asking your first. You should always have the option to decline DCC, but this isn’t always the case. Additionally, some merchants will tack on additional charges on top that makes choosing DCC even less attractive.īottom Line: Even if you have a charge with no foreign transaction fees, you might still be hit with DCC if you opt to pay in USD instead of local currency. DCC is generally around 7%, but per a case study, can be anywhere from 2.6% all the way up to 18%!ĭCC isn’t a good deal for consumers since retailers choose exchange rates that favor them. This might sound like a good deal since you’ll know the cost of your purchase in dollars immediately, but a high currency conversion rate will be tacked on for this convenience. Or you might have visited an ATM that allows you to “lock in a conversion rate” at independent providers such as Travelex. You might be familiar with dynamic currency conversion (or DCC) if you’ve made a purchase abroad and the merchant asks whether you’d like to be billed using your home currency versus local currency. For example, Visa and Mastercard both charge a fee of 1% on all transactions. This currency conversion fee can also be charged by the ATM network you use. Network Currency Conversion FeesĪ currency conversion fee (also known as a network fee) is charged by your credit card processor ( Visa, Mastercard, American Express). Your credit card’s issuer, like Chase or Citi, will charge you a percentage of the amount of a transaction (typically 2%) to process. The 2 fees that make up this 3% include : Issuing Bank Fees If there are any foreign transaction fees, they will be listed under the general fees section that can be found right below the interest rates. This information is required under the Truth-in-Lending Act to be standardized, making it fairly straightforward to find what you’re looking for. This can be found online through your account or within the disclosures when applying for a new card. If you’re looking for the foreign transaction fee for your specific card, you can find it by looking within the Schumer box in your credit card’s terms and conditions. 3% is the typical foreign transaction fee that is charged. It will show up as a separate line item on your credit card statement.

In this article, we’ll look at the foreign transaction fees and currency conversion charges that you’re likely to encounter when traveling.Ī foreign transaction fee is what you will be charged when you buy something in a foreign currency or the charge is passed through a foreign bank. Unfortunately, using credit and debit cards internationally can sometimes result in huge foreign transaction fees - and understanding these fees can be complicated. You can avoid carrying large amounts of cash, benefit from your card’s automatic currency conversion, and withdraw cash from ATMs as needed. Credit and debit cards are some of the easiest ways to pay for goods and services while traveling internationally.

0 kommentar(er)

0 kommentar(er)